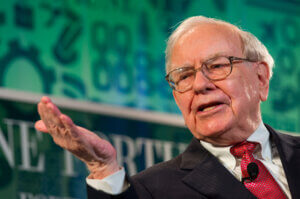

Warren Buffett has recently engaged in a significant sell-off of stocks while amassing a substantial cash reserve. This investment strategy reflects a cautious approach to a potentially overvalued market, as he anticipates a possible economic downturn or correction.

Buffett’s Berkshire Hathaway continued to sell more stocks than it purchased during the third quarter of 2024, according to recent regulatory filings.

The holding company has revealed that it sold approximately 100 million shares of Apple, representing a 25% reduction in its stake. Moreover, Berkshire divested a total of $36.1 billion in stocks, which included several billion dollars’ worth of shares from Bank of America, while making only $1.5 billion in new investments.

Its cash reserves have grown to an unprecedented $325.2 billion, marking the eighth consecutive quarter in which Berkshire has increased its cash holdings.

At present, Buffett seems to be adopting a watchful stance, hesitant to commit significant capital until market conditions become clearer. His wait-and-see approach may stem from current market volatility. The United States Presidential election, ongoing inflation concerns, looming recession fears and anticipated Federal Reserve rate cuts could be influencing his preference for maintaining substantial cash reserves. This tactic echoes his response during the early stages of the Covid-19 crisis, when Buffett refrained from major investments due to the uncertain economic landscape.

In May, Buffett indicated that he anticipated Apple would continue to be Berkshire’s largest stock investment. However, he decided to sell some shares, believing that the 21% federal tax rate on capital gains was likely to increase, Reuters reported. However, it appears unlikely that capital gains tax rates will rise under President-elect Donald Trump and a Republican-controlled Congress. In fact, Trump has indicated a desire to maintain or potentially lower capital gains taxes as part of his broader tax agenda.

Additionally, inflation rose in October, the Bureau of Labor Statistics reported on Wednesday. The consumer price index, which tracks the costs of various goods and services, increased by 0.2% for the month. This brought the annual inflation rate to 2.6%.

Federal Reserve Chair Jerome Powell said on Thursday that the central bank will approach interest rate cuts with caution and measured steps in the upcoming months. He emphasized that while inflation is approaching the 2% target, it has not yet reached that level.

“The economy is not sending any signals that we need to be in a hurry to lower rates,” Powell stated.

In his remarks, he suggested that inflation might remain slightly above the Fed’s target in the near term, but he remains confident that it will gradually decrease, acknowledging that the path may not be entirely smooth. Powell stressed that the Fed will carefully monitor inflation’s trajectory before making any significant monetary policy changes.

Economists anticipate the Fed will implement another quarter-point interest rate reduction in December, following a quarter-point cut last week and a half-point reduction in September. However, the trajectory of future rate cuts remains uncertain. After Powell’s measured comments, market participants dramatically scaled back their expectations, with the probability of a December rate cut dropping from 83% to just under 59%, according to the CME FedWatch.

What Does This Means For The Job Market?

Investor uncertainty can trigger widespread consequences for both businesses and their employees. In such climates, companies often struggle to attract capital or secure new investments. Risk-averse investors typically shy away from ventures they deem uncertain, potentially hindering corporate growth and development.

Public companies may experience stock price declines due to investor wariness, diminishing their market valuation and potentially constraining their ability to raise funds. This uncertainty can lead businesses to delay crucial decisions regarding investments, recruitment or growth strategies.

Financial strain may force companies to take defensive measures such as implementing hiring freezes, cutting work hours or resorting to workforce reductions. These actions can create a pervasive sense of job instability among employees, further exacerbating the economic impact of investor uncertainty.

Source: Forbes